Table Of Contents show

Last Updated on 10 February, 2024 by Rejaul Karim

There are many trading indicators out there to choose from as a technical trader. While they all have their differences both when it comes to the formulas they rely on and the type of data they analyze, they have one thing in common, namely that they make the movements of the markets easier to interpret. One trading indicator which makes use of two individual data streams to analyze the markets, is the On Balance Volume indicator, often called “OBV”.

OBV vs RSI – OBV is a trading indicator that combines the direction of the price with volume, to give us a sense of the strength of the trend at the moment. As such, OBV becomes a confirmation tool to gauge the likelihood that the trend is going to continue in the current direction.

Trading Strategy MembershipMonthly Edges

$42 per strategy

Tradestation code and workspace included

Read More

In this article, we’ll go through how some traders choose to use the indicator, in line with the traditional interpretation. You’ll also learn the main differences between the OBV and the RSI, as well as the main limitations of the indicator.

Let’s start!

How Does OBV Work?

As we mentioned in the introduction, OBV is a trading indicator that uses not only the price action of the market, but also the volume, to get a sense of which direction the bulk of the market forces are headed. In order to achieve this, it uses a cumulative volume value, where positive volume is added to the current OBV value, while negative volume is subtracted.

Volume is considered negative if the close is lower than the previous close, and positive if it’s higher than the previous close.

So, what does this imply about the indicator itself, and how does the indicator show on a chart?

Let’s find out!

How to Read OBV

Reading the OBV line is really simple. It appears at the bottom of the chart, and the following rules apply:

- If the OBV line is rising, it means that the volume on positive days is higher than the volume on negative days. In other words, the market climate is deemed bullish.

- Conversely, if OBV is falling, it means that the volume on negative days is higher than the volume on positive days. In other words, the market climate is deemed bearish.

As a result, many traders want to see that bullish trends are accompanied by a rising OBV value, while bearish trends should be accompanied by a falling OBV value.

This shows that the market forces, and especially the so-called “smart money” is in line with the current market trend, and perhaps most importantly, is supportive of it!

So, in short, the rationale behind the OBV indicator is that price should follow volume.

In the image below we see how a bullish trend developed, together with a rising OBV value. This signals that the overall market climate is positive, and supportive of the ongoing bullish price moves.

The image below instead shows how the bearish trend was coupled with a declining OBV line, which helped to persuade us that the bearish forces were strong enough to guarantee a continuation of the bearish trend.

As you see in the examples, traders aren’t usually that concerned with specific OBV levels, but tend to look more at the slope of the curve.

How is OBV Calculated?

The OBV formula acts cumulatively in that it constantly adds or removes the volume of the current bar, from the accumulated OBV value. Here is how it’s done:

If the close of this bar is higher (greater) than the close of the previous bar, then:

OBV= OBV of the previous bar + volume of the current bar (Today’s Volume)

If the close of this bar is lower (less) than the close of the previous bar, then:

OBV=OBV of the previous bar – volume of the current bar (Today’s Volume)

If today’s close is the same as the close of the previous day, then:

Current OBV Reading = Previous OBV

Is OBV a Leading Indicator?

Limitations of OBV

According to Granville’s original belief, changes in volume direction, which are visualized through OBV, would come before the actual price change itself. This is one of the core assumptions, which explains why the indicator is believed to forecast price reversal.

However, while the OBV may in fact succeed in forecasting some reversals, it often provides false signals that never lead to a reversal of the trend. This, of course, is an issue that you’ll be faced with regardless of the indicator you choose to employ. Most of the time, this is remedied by applying additional conditions or indicators that improve the hit rate of the system.

Another thing to be aware of is that eventual volume spikes during earnings reports or similar events could render the indicator useless for a long time forward going forward. The reading then has simply been thrown off, and might not be relevant until future price action starts to behave normally again.

OBV Trading Strategies

When it comes to using the OBV in trading, there are quite a lot of trading strategies you could build using this indicator. However, many of those strategies are going to rely on the OBV as a type of filter, and leave the exact entry point to be decided by another entry trigger that’s more exact.

That’s not to say that the OBV couldn’t act as an entry trigger on its own, but in many of the cases, it won’t be exact enough. After all, traders usually just regard the overall direction of the indicator line, rather than the exact level.

With this said, let’s have a look at some ways that you could either use the OBV on its own, or together with other entry and exit triggers, to form trading strategies.

Divergences

One common approach when using the On Balance Volume indicator, is to look for divergences between the price and the OBV line. As you might know, a divergence is when the OBV line goes in one direction, and the price goes in the opposite direction. In traditional technical analysis, a divergence is a sign that a trend reversal might be imminent, and could be worth looking for.

While divergences can be useful to get a sense of when it’s time to look for a trend reversal, it is important to note that it doesn’t provide the final entry trigger. As a result, divergences can often continue for long periods of time, before the market actually turns around.

So what could you use for the final entry trigger? Well, it completely depends on the market and timeframe you trade, but here are some examples of signals that could be worth having a closer look at:

1. A breakout: You may wait for the market to breakout out past a breakout level of your choice. The fact that the market now finally has started to move in the same direction as the OBV line, could be the trigger that’s needed!

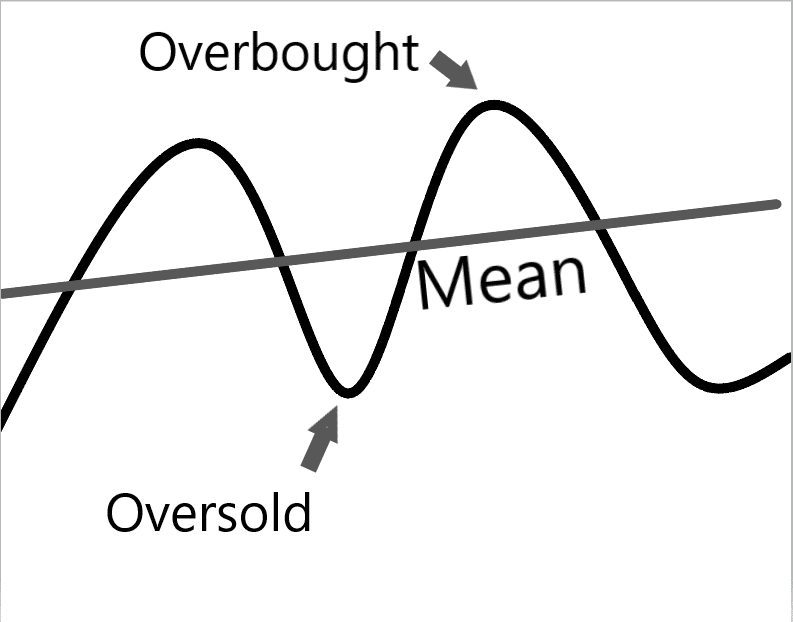

2. An Oversold Or overbought signal: In some markets, such as stocks and equities in general, there is a quite strong tendency to revert to the mean. This means that they often perform exaggerated moves in either direction, which are then corrected by a move in the opposite direction. If the market has moved too much in the direction of the current trend, while the OBV is going in the opposite direction, that could be a signal to enter the market.

In our guide to overbought and oversold conditions, you can read more about different approaches to finding and making use of overbought and oversold levels in the market.

3. Seasonality: Some markets have very strong tendencies that come back at certain intervals. For example, some markets will have certain parts of the month, or even weekdays, when they’re more bullish or bearish than others. If you happen to find that you’re in a part of the month which resonates with the meaning of the divergence you’re watching at the moment, that could make it more probable that the market will actually turn around.

For instance, if you are watching a bearish divergence, and the market enters a month that historically has been very bearish, then you might be more inclined to act on that signal.

Breakouts

We already mentioned breakouts briefly in the above text, but it’s worth recognizing that breakouts may not only occur in the price chart, but could also form in the OBV indicator itself.

The typical approach of watching and acting on breakouts is to wait until a specified level has been broken. The breakout level is often made up of a recent high, low, or a resistance or support level.

There is nothing that says that this very concept can not be applied to the OBV line. For instance, you could define the highest OBV level 20 days back, and decide to go long if the market breaks past this level.

You could also add some distance to the breakout level, which is often done in normal breakout trading, in order to reduce the impact of false breakouts.

In other words, you could attempt to approach breakout trading in the OBV line exactly as you would in the price chart.

Trend Confirmation

Just as we mentioned earlier, one of the most common OBV trading methods, is to gauge the strength and direction of the on-going trend. This is done by assuming that a strong trend should be coupled with an OBV line that goes in the same direction.

Now, what we haven’t discussed so much is the slope of the OBV line. As is quite obvious, a trend that witnesses an increased OBV line slope means that the trend is getting stronger, and that more market participants are looking to enter the market.

However, a too drastic increase in the slope of the OBV line, might not suggest that the trend is worth catching, but that it’s approaching the end.

If you are familiar with the basics of market psychology, you know that people tend to be most positive once a trend is nearing its end. This has to do with that people use their experience and what they have seen in the past, to form their view of what’s coming. As a result, the most positive market sentiment is usually found at the end of a trend, when the market has already performed most of its moves in the direction of the trend.

An OBV line that takes off sharply could, therefore, be seen as a signal that market sentiment is becoming too positive in the case of a positive trend, and too negative in the case of a negative trend. Thus, we might expect there soon to be a reversal.

Just as with the divergence signal covered earlier in the article, you usually need a more exact entry signal, since the market may continue in the direction of the trend, despite the big OBV move!

Important!

Just remember that all the strategies that have been presented above must be tested thoroughly on the market and timeframe you intend to trade. In contrast to what many people believe, trading strategies don’t work in all markets. Quite on the contrary, every market has its own quirks and behavior that must be taken into account when designing strategies.

We recommend that you use backtesting to find out what strategies are worth your time, and which aren’t. You can read more about backtesting and how to construct a trading strategy in our complete guide to building a trading strategy.

OBV vs RSI

RSI is one of the most popular trading indicators around, and is quite different from the OBV indicator. While OBV relies on both price and volume data, RSI looks only at price, and measures the momentum of the price changes, instead of the volume on up and down days.

Still, some people like to combine the two to get a broader picture of what happens in the market. But is this a viable approach?

Can You Combine RSI and OBV

For sure! Earlier in the article, we discussed the need for a more exact order entry trigger, and the RSI could very well provide us with a signal that manages to successfully pinpoint when it’s a good time to enter. If you want some examples of how RSI could be used in trading, we recommend that you look closer at our big guide to the RSI indicator!

However, some traders might choose to use the OBV value, as the input for the RSI indicator. Normally, RSI is calculated on the close price of every bar. And while this is the typical configuration, many people have not realized that you could use whatever value you prefer.

For instance, you could calculate RSI off the open, high, or low of the bar, or as in this case, the OBV line.

Using an indicator like the RSI on top of the OBV will help to visualize and measure changes in the OBV line, and could certainly lead to you finding new, profitable trading opportunities!

Ending Words

In this article we have had a look at the traditional interpretation of the OBV indicator, as well as how some traders choose to use it together with other indicators and tools, to find profitable trading opportunities.

Before ending the article, we just wanted to once again touch on the incredibly important topic of trading strategy validation. Most traders just take some concepts and apply them straight onto the markets, without knowing if their strategy really works.

Such an approach is disastrous. Mosttechnical analysis doesn’t workvery well in its pure form but must be tweaked to suit the market and timeframe you’re working with.

If you want to learn more about how to construct a viable trading strategy that works, we have the following free resources available:

- Thedefinitive guide to algorithmic trading

- OurSwing trading guide

- Our article onhow to build a trading strategy

FAQ

How does OBV work, and what information does the OBV line provide?

OBV works by adding positive volume to the current value and subtracting negative volume. The OBV line, visible at the bottom of the chart, indicates a bullish trend when rising and a bearish trend when falling. The slope of the curve is crucial, reflecting the strength of market forces supporting the trend.

Is OBV a leading indicator, and what are its limitations?

OBV is considered a leading indicator, as it aims to forecast price reversals based on changes in volume direction. However, it may provide false signals. Traders often use additional conditions or indicators to enhance accuracy. External factors like volume spikes during events can temporarily render the indicator less useful.

How can traders use OBV in conjunction with the Relative Strength Index (RSI)?

Traders can combine OBV and RSI for a comprehensive market analysis. While OBV focuses on both price and volume, RSI measures the momentum of price changes. Using OBV values as inputs for RSI can provide a broader perspective and help identify new trading opportunities.

Trading Strategy Membership Monthly Edges

$42 per strategy

Tradestation code and workspace included. Also plain english for Python Coders.

Click Here Now

![]()

Previous

Next